Active Funds vs Index Funds

When you finally decide to start investing and turn your attention to the lineup of investment trusts, you may find that there are too many products lined up.

In this article, we will focus on the differences between “active funds” and “index funds” as a major classification of investment trusts, and explain the characteristics of each and points to note when selecting them.

If you’re not in the stage of investing in the first place and want to study the basics of investing a little more before thinking about it, read the article summarized below to improve money literacy (Japanese only).

・People who cannot decide because there are too many types to purchase investment trusts

・People who are interested in the term “index investment” but do not understand it well

・People who want to actively buy and sell and make a lot of money

Efficient growth of assets is important

Index funds

Index means benchmark. This is a different usage from the meaning of the index / headline when a blog article is indexed by Google.

For example, it refers to the average or index of the stock prices of so-called excellent companies such as the Nikkei Stock Average and NASDAQ100.

An index fund is an investment trust that manages with the aim of making the same price movement as an index with a base price. Normally, the stock composition is exactly the same as the stock group used in the target index, and adjustments are made including factors that affect the inclusion ratio, such as the market capitalization weighted average.

In other words, for example, an index fund linked to the Nikkei Stock Average will have the same price movements as the Nikkei Stock Average.

There is no need for an independent individual company survey on the composition of the stocks to be included, and when the stocks used in the index are replaced, the fund will also sell the stocks of the companies that are not included in the index.

The fund then buys stocks of companies newly adopted in the index, so it is possible to follow the index.

Active funds

An active fund is a fund in which a person in charge of management, generally called a fund manager, independently decides the stock allocation of the investee and aims for investment performance higher than the index.

Fund managers select bargains that are not included in the index, try to increase the shareholding ratio of companies that are expected to grow, and build a portfolio that seems to be optimal at any given time based on their own research results.

Which is better?

Comparison of investment results

There is no end to the debate over which is better, index funds or active funds, which is better for asset formation. If you have been wondering what kind of investment trust to buy, you may have heard of it once.

First of all, conclusion is below:

You may have felt that it was lower than expected. Or for those who are studying well, you might have thought “Isn’t it lower?”. The figures will vary depending on the calculation method, but the above result of 40% or less is the result of totaling the investment results of funds investing in each country on the site called SPIVA.

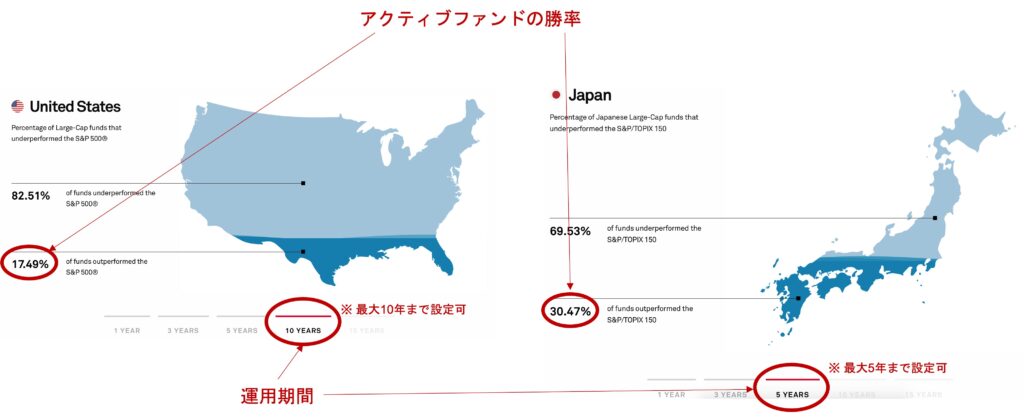

Looking at the United States and Japan, where you mainly invest, it looks like this: The comparison is based on the maximum period that can be set for each (as of October 2021).

The winning percentage of active funds is only 17.49% for a 10-year investment in the United States. The result is 30.47% of the investment in Japan for 5 years. On the flip side, if you are investing in the United States, if you invest in the index (the index in the figure is the S&P500) for 10 years, there is a 80% or more chance that you will be able to outperform the active fund.

Simply looking at the “win rate”, it can be said that the index fund wins.

Trust fee comparison

The root cause of this low win rate for active funds converges on the fact that no one knows when to buy. Please refer to the detailed explanation below (Japanese only).

In addition, there is another big reason. For active funds, the fund manager adjusts the portfolio, which incurs a commission. When you buy an active fund investment trust, you pay for the work. In most cases, it is not specified exactly how much the consideration is, but it is reflected in the trust fee of the investment trust.

To put it plainly, active funds have high trust fees. It is several times that of index funds, and even if it is only a few percent, if it accumulates, it will be a big negative for investment trust purchasers.

At the extreme, you might just be paying extra costs to a fund manager who can’t make more money than the index.

Portfolio comparison

So how much is the fund manager devising to deal with the difficulty of selecting such stocks? Let’s take a portfolio with NASDAQ100 as an example. The figure below shows the portfolio of active funds (US NASDAQ Open B course) on the left and index funds (iFree Leverage NASDAQ100) on the right.

As you can see, the ratio of GAFAM is large in both cases, but since the right side is NASDAQ100 itself, the active fund is in a state of “imitating” it. It seems that other stocks are being adjusted independently, but that does not seem to lead to large returns.

Since the difference in profits varies depending on the time of year, I will not make a definitive expression in this article. If you have read this article, please check the performance of these two investment trusts immediately. The index funds shown on the right have lower trust fees and are leveraged than the active funds shown on the left. As a result, the fund is significantly accelerating the return on index investments, which tend to perform even better than active funds. However, there are some things to understand about leveraged investment, including declining risk, so please refer to the following articles when considering investment (Japanese only).

Conclusion

We have compared active funds and index funds from various perspectives. I think you could get a general idea of what the difference is and which one is better in actual operation results. I have done all the factual analysis.

And the bottom line is that, at least in the past, it was more likely that you would get a return on an index that is known to grow as society grows, rather than thinking about it and moving actively.

Of course, it is up to the individual to decide what kind of investment to make, and there is no doubt that it is the responsibility of the individual. However, if you do not have a deep insight into investment, it is better to first understand the movement of indexes and the structure of investment trusts, and to consider investing in indexes in order to get used to the price movements of products.

You can see the overview article for investment beginners from the following, so please use it if you like (Japanese only).

コメント